XBRL Filing Company  CIK 0001017386

CIK 0001017386

XBRL Filing Company is a real corporation based in California.

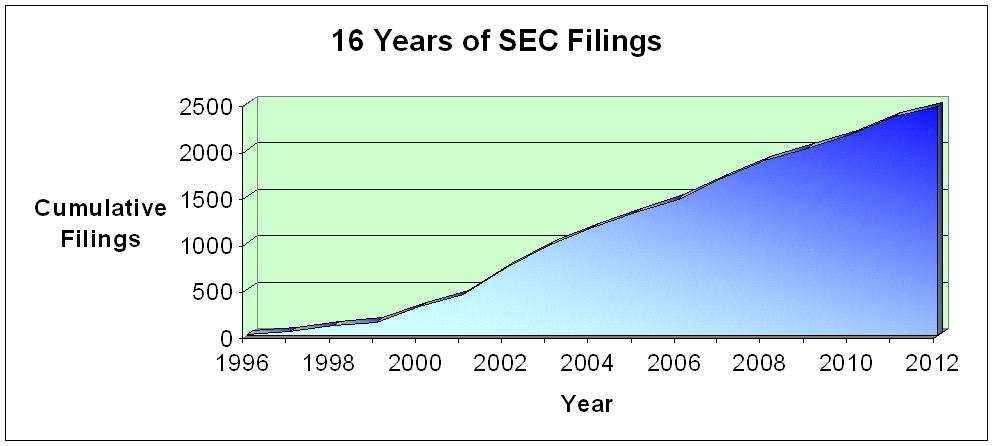

We have been a registered SEC Filing Agent from the time we started business in 1996. Since then we have submitted over 2,500 filings. Our CIK is 0001017386. Look us up.

Incorporated in 1996 as Completion Corp., we use the dba XBRL Filing Company so people can easily understand what we do.

16 years in business. 16 years of SEC filings. We look forward to helping you complete your XBRL filing on time and with quality.

What follows below are two original articles we published last year in response to the XBRL confusion. Please contact us with your comments and questions.

2011 XBRL SEC Mandate For Public Companies -- A Simple Look

Part One: Should I care? (First of a three-part series, BS"D)

Can you spell XBRL? Or is it XBLR? We have a hard time keeping it straight in our Edgar filing office. This acronym is multiplying in popularity or rather infamousness among public companies as the year 2011 waxes full.

We are talking about the SEC mandate, now beginning its third year, requiring all companies that file a 10K to now also file XBRL Interactive Data. While many and magnanimous benefits surround XBRL filing, this has public companies running scared - and many companies are just sticking there heads in the ground hoping that the SEC is just bluffing.

On this topic I have seen a lot of misinformation, confusion, and scare tactics. Well meaning folks are trying to encourage public companies to be responsible (and hopefully profit in some way). My goal is to go right to the bottom line: the straight scoop.

2011 is the third year of the SEC three-year rollout, and it is happening. More than 1,500 companies are already filing XBRL interactive data with the SEC each quarter. They have struggled, invested time and money, and are current with their filings. This is not going away.

It is estimated that 8,700 companies are required to file XBRL interactive data for the first time this year (2011). It is also estimated that at least half of those companies have not yet decided how they will meet this requirement.

Consequences

So what is the penalty if I don't comply? What happens if I ignore this and just wait for the SEC to let me know?

If you flip to page 24 of the SEC's Final Rule on Interactive Data to Improve Financial Reporting, you will see there that ignoring this filing is just about the same as ignoring filing your 10k or 10q. The SEC reports the registrant as not being current with its filings, and all of the punitive action accompanying that status applies. Actually it's not really that bad, because once you do file your XBRL interactive data, the SEC will consider you current with your filings.

On the positive side, filing XBRL interactive data with the SEC is actually a service to investor communication benefiting stock holders, analysts, and the company itself. You may want to review "How XBRL improves analysis," by Michelle Savage.

Action Plan

Ok so what actually do I need to do? You need to file a new exhibit at least four times a year. Exhibit 101, "Interactive Data" must accompany your 10-K and each of your 10-Q filings. Alternatively, EX-101 may be filed by attaching it to an 8-K. Any time you file financial statements (e.g., S-1 Registration, amended 10k or 10q, special purpose 8k, etc.), an Exhibit 101 must be filed. The SEC provides more details under Rule Release No. 33-9002.

The trick is managing the time and expense needed to prepare Exhibit 101. More on that as well as the filing deadlines to be addressed in the next article.

Part Two: When is the XBRL deadline? (Second of a three-part series, BS"D)

Ok, when exactly do I have to file my XBRL interactive data with the SEC? Let’s face it, this is a big expense, we need to prioritize our spending. In Part One of this series, we addressed the question, “Why should I care?” Hopefully we are beyond that, and now it’s just a matter of getting it done at the right time (and the right price -- see Part Three).

The simple answer is Monday, August 15, 2011. For some companies the deadline might be as late as February 13, 2012. Please consider the caveat presented at the end of this article.

Now we are talking about the estimated 8,700 companies having common stock with “a market value of less than $75 million or … less than $50 million in revenue.” The SEC requires these companies to file their XBRL interactive data for the first time this year.

Here’s how the SEC describes the deadline:

“companies … will be subject to the same interactive data reporting requirements beginning with a periodic report on Form 10-Q … for a fiscal period ending on or after June 15, 2011. “

To give an example: a company with a 12/31 fiscal year end will complete its second quarter on June 30, 2011 and file its 10Q on or before August 15, 2011. The SEC requires that the XBRL interactive data be filed “at the same time as the rest of the related report….” Which is Monday, August 15.

The Grace Period

Page 24 of the SEC’s Final Rule 33-9002 then offers additional time for the first XBRL filing: “The initial interactive data exhibit of a filer will be required within 30 days after the earlier of the due date or filing date of the related report….” So, continuing our example, Wednesday, September 14, 2011 becomes the last day to file the XBRL interactive data. Beyond that date, consequences apply (please see Part One of this series).

A second example: a company on a 6/30 fiscal year will complete its first quarter on September 30, 2011 and file its 10Q on or before November 14, 2011. The SEC XBRL requirement begins with the first 10Q after June 15, not the 10K. The Financial statements in interactive data format, therefore, are due on or before November 14, 2011 -- with the grace period, as late as Wednesday December 14, 2011 (assuming the 10Q is filed on its due date).

Keep in mind that if you are proactive and file your 10Q before the due date, the grace period clock starts ticking when you file. That means that if you file your 10Q on, July 5, the XBRL interactive data filing becomes due Thursday August 4 -- that's with the grace period.

Another requirement to keep in mind is that the SEC requires filer’s “financial statements in interactive data format on its corporate Web site not later than the end of the” same day. Make sure to plan time for posting the XBRL on your corporate website.

Deadline Caveat

Remember how things go as deadlines approach. Anxiety level increases; quality decreases; resources to get it done become scarce and/or more costly. Filing agents know this and are trying to communicate this to their customers.

If I may recommend a strategy, my personal favorite is to avoid the deadline rush by starting now. Take your current financials being filed (or recently filed) with the SEC and convert them to XBRL. The first time is where most of the work is. You may file them with the SEC now or not. That’s up to you. When the real deadline hits in August, November, or February 2012, depending on your fiscal year, you are ready to roll out your interactive financial data with ease.

Final Example

Have you figured out how the it’s possible for a company to not file its first XBRL interactive data until February 13, 2012? Take a company with an August 31 fiscal year end. Its third quarter ends May 31. That is before June 15: too early for the SEC mandate to kick in. The first quarter for this company ends November 30, 2011, and its 10-Q is due by January 14, 2012 (which is actually pushed off to January 17, 2012). Add the grace period, and you have February 13, 2012. (The grace period is counted from the January 14 due date.)

On an XBRL filing technical note, the question is asked about block tagging vs. detail tagging? Without getting into what it is, block tagging is what is required this year; detailed tagging comes after a year of filing with block tagging. In other words, tune in next year for more on detail tagging. Let’s stay focused on what we have to do this year.

What is it going to cost in time and dollars? That is the topic of Part Three.